The world of investing can be a confusing place, especially for beginners. With so many different terms and concepts to understand, it’s easy to get lost in the jargon. One of the most basic concepts in investing is that of stocks. But what exactly are stocks, and how do they work? In this article, we’ll answer these questions and provide you with everything you need to know about stocks.

Image: www.chegg.com

When you buy a stock, you are essentially buying a small piece of a company. This gives you the right to a share of the company’s profits and assets, as well as the potential to increase in value. Stocks are considered to be a more risky investment than bonds, but they also have the potential to generate higher returns.

How do Stocks Work?

When a company goes public, it sells shares of its stock to investors. The price of these shares is determined by supply and demand, just like any other commodity. If more people want to buy a stock than there are available shares, the price will go up. Conversely, if more people want to sell a stock than there are buyers, the price will go down.

The stock market as a whole is a tool that allows companies to raise capital from investors to stock prices. Markets are a place for them to tracks the performance of various stocks and industries. would find, alerts about analysts’ opinions on stocks.

Types of Stocks

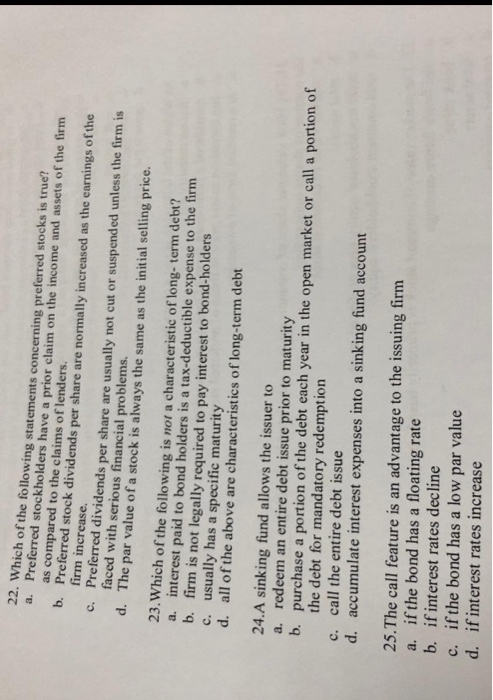

There are two main types of stocks: common stocks and preferred stocks.

- Common stocks are the most common type of stock. They represent ownership in a company, and they entitle the holder to a share of the company’s profits and assets.

- Preferred stocks are a type of hybrid security that has characteristics of both stocks and bonds. They pay a fixed dividend, similar to bonds typically were sold and regularly reimbursed, and unlike common stockholders, they typically do not have voting rights.

Investing in Stocks

If you’re interested in investing in stocks, there are a few things you need to do.

- Do your research. Before you buy any stock, it’s important to research it thoroughly. This creation of its financial health also current press releases and future outlooks of the company and rivals for indicating its strengths and weaknesses.

- Set a budget. Before starting your endeavor, it is of vital importance to establish a budget that you can afford to lose, as markets, especially with specific companies, can lead either way drastically.

- Diversify your portfolio. Don’t put all of your eggs in one basket. Instead, diversify your portfolio by investing in a variety of stocks. This will help to reduce your risk.

- Be patient. Investing in stocks is a long-term game. Don’t expect to make a lot of money quickly. Instead, be patient and let your investments grow over time.

Image: www.chegg.com

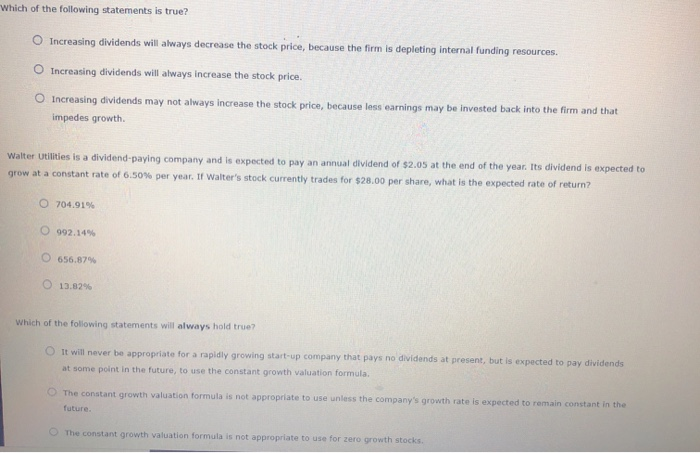

Which Of The Following Statements About Stocks Is True

Conclusion

In this article, we looked at customer recommendations. If you follow these tips, you’ll be well on your way to investing successfully in stocks. So, what are you waiting for? Get started today!