Imagine you’re investing a chunk of your savings into a government-backed security. You’ve heard of Treasury bills, known for their safety and relatively short maturities. But amidst the financial jargon, one term keeps popping up: the bid price. What exactly does it represent in the world of Treasury bills? Buckle up, as we embark on a comprehensive exploration of the bid price, peeling back its layers to reveal its significance for discerning investors like you.

Image: www.chegg.com

Understanding Treasury Bills

Treasury bills, or T-bills as they’re commonly called, are short-term debt instruments issued by the U.S. government. Considered among the safest investments available, T-bills have maturities ranging from as short as 4 weeks to as long as 52 weeks.

When you invest in T-bills, you’re essentially lending money to the government for a specified period. In return, the government promises to repay you the face value of the bill on its maturity date. But here’s where it gets interesting. You don’t always pay the face value of the bill upfront; instead, you purchase it at a discounted price known as the bid price.

How the Bid Price Works

The bid price of a T-bill reflects the present value of its future income stream, discounted by the prevailing market interest rates. It represents the amount of money you’d pay today to acquire the right to receive the face value of the bill upon maturity.

For instance, consider a 12-month T-bill with a face value of $1,000. If the prevailing market interest rate is 2%, the bid price of the T-bill would be $980.02. By purchasing the T-bill at this discounted price, you’ll earn interest over the 12-month period, resulting in a return of $19.98.

Factors Influencing the Bid Price

Several factors can influence the bid price of T-bills:

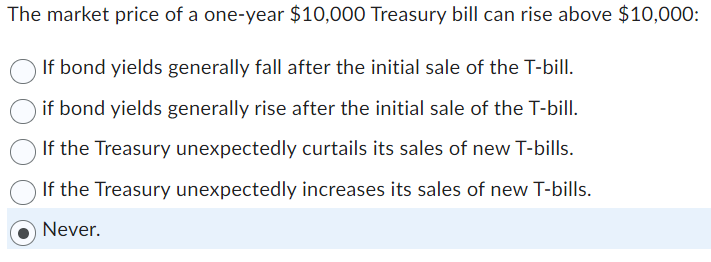

- Market Interest Rates: As interest rates rise, the bid price of T-bills tends to fall, and vice versa.

- Expectations of Future Interest Rates: Investors anticipate future interest rate movements, and their expectations can impact the bid price.

- Economic Conditions: Economic growth, inflation, and unemployment rates can affect the demand for T-bills, consequently influencing their bid price.

- Liquidity: T-bills are highly liquid, but changes in market liquidity conditions can impact their bid price.

- Supply and Demand: Market conditions, such as changes in government borrowing needs or investor demand, can affect the supply and demand dynamics of T-bills and, in turn, their bid price.

Image: pocketsense.com

Expert Tips and Advice

Mastering the bid price of T-bills can help you make informed investment decisions:

- Consider Interest Rate Direction: Monitor market interest rate trends to gauge potential changes in the bid price.

- Seek Professional Guidance: Consult with a financial advisor for personalized advice based on your investment goals and risk tolerance.

- Choose Appropriate Maturities: Match T-bill maturities to your short-term investment horizon.

- Stay Informed: Track economic news and events that may affect the bid price of T-bills.

- Diversify Your Portfolio: Incorporate T-bills as a component of a diversified investment portfolio.

Reiterating the Tips for Better Understanding

These expert tips emphasize the importance of staying attuned to market dynamics, seeking expert advice, customizing your investment strategy, and staying abreast of economic developments. By integrating these tips into your investment decisions, you can navigate the complexities of the bid price for T-bills with greater confidence.

Frequently Asked Questions on the Bid Price

- What is the bid price of a T-bill?

The bid price represents the present value of the future income stream, discounted by the prevailing market interest rates. - Why does the bid price fluctuate?

The bid price is influenced by factors such as market interest rates, economic conditions, and supply and demand. - How can I interpret the bid price?

The bid price indicates the amount you’d pay today to receive the face value of the T-bill upon maturity. - What are the risks associated with T-bills?

T-bills are considered highly safe investments, but they are subject to interest rate risk and the risk of changes in the economic climate. - Where can I invest in T-bills?

T-bills can be purchased through online brokerages, banks, and government bond dealers.

The Bid Price Of A Treasury Bill Is

Conclusion

The bid price is a crucial factor to consider when investing in Treasury bills. By understanding its workings, you gain a competitive edge in navigating the dynamic world of short-term fixed income investments. Remember, seeking expert advice, staying informed, and diversifying your portfolio are key to making informed decisions and optimizing your returns. If you’re intrigued by the topic of the bid price of Treasury bills and want to delve deeper into this fascinating subject, leave a comment below and let’s continue the discussion.