Introduction:

Image: printableformsfree.com

Managing finances is a crucial aspect of any business, and understanding the various accounts that contribute to the overall financial health is essential. One of these accounts is the accounts receivable, which holds significant importance in determining a company’s financial stability and liquidity. In this comprehensive article, we will delve into the realm of accounts receivable, exploring its definition, significance, and various aspects that impact business operations.

Understanding Accounts Receivable

Accounts receivable refers to the money owed to a business by its customers for goods or services that have been delivered but not yet paid for. It is a crucial asset for any organization as it represents the amount of revenue that is expected to be received in the future. Maintaining healthy accounts receivable is critical for ensuring a smooth flow of cash into the business, enabling the payment of expenses, investment in operations, and ultimately contributing to profitability.

Classification and Types:

Accounts receivable can be classified into various types, depending on the age of the debt and the related customer’s payment history. The most common classification is based on the time since the invoice was issued:

- Current accounts receivable: These are invoices that are unpaid within the stipulated payment terms, usually within 30 or 60 days.

- Overdue accounts receivable: Invoices that have not been paid past their due date falls under this category. Days Sales Outstanding (DSO) is a key metric used to track the average number of days it takes for customers to pay their invoices. High DSO can indicate potential cash flow problems or inefficiencies in the billing and collection process.

- Bad debt: Accounts receivable that are considered unlikely to be collected due to customer insolvency, bankruptcy, or other factors are categorized as bad debt. Businesses set aside an allowance for bad debts to account for potential write-offs.

Importance of Managing Accounts Receivable:

Effective management of accounts receivable is essential for the financial well-being of a business. It impacts several key areas:

- Cash flow: Accounts receivable have a direct impact on cash flow, as they represent future cash inflows. By optimizing the collection process and reducing the DSO, businesses can improve their working capital and increase their liquidity.

- Profitability: Maximizing revenue is a fundamental aspect of profitability. Lost or uncollected accounts receivable result in reduced revenue generation, directly impacting the bottom line.

- Customer relationships: Maintaining a positive relationship with customers is crucial in the long run. Appropriate invoicing, clear payment terms, and efficient collection strategies can contribute to customer satisfaction and retention.

- Risk assessment: Unpaid invoices can indicate potential customer credit issues. Properly evaluating customer creditworthiness before extending credit can help businesses reduce the risk of bad debt and protect against financial losses.

Strategies for Optimizing Accounts Receivable:

Businesses can implement various strategies to optimize their accounts receivable management and strengthen the financial health of their organization:

- Establishing clear payment terms and policies: Setting明確な支払い條件that outline the time frame for payment, discounts for early payments, and late payment penalties can help set clear expectations and encourage timely payments.

- Regular invoicing and follow-up: Maintaining accurate and timely invoicing ensures that customers receive invoices promptly and can make payments on time. Establishing a follow-up system for overdue invoices can help businesses stay on top of collections and reduce DSO.

- Customer credit evaluation and risk management: Assessing customer creditworthiness before offering credit terms is important to minimize the risk of bad debts and protect cash flow. Implementing credit checks, using credit scoring models, and monitoring customer payment histories can enable businesses to make informed decisions about extending credit.

- Offering flexible payment options: Providing multiple payment options, such as online portals, credit cards, or wire transfers, can offer convenience to customers and increase the likelihood of on-time payments.

- Leveraging technology and automation: Utilizing accounting software, payment processing systems, and customer relationship management (CRM) tools can streamline accounts receivable processes, improve efficiency, and reduce manual errors.

In conclusion, understanding and effectively managing accounts receivable is critical for the financial health and stability of a business. Implementing effective strategies to optimize collections and customer payment behavior positively impact cash flow, profitability, and overall financial performance. By maintaining clear communication, establishing robust processes, and leveraging technology, businesses can enhance the efficiency of their accounts receivable management and foster strong customer relationships that contribute to the long-term success of their organization.

Image: www.jdtaxaccounting.com

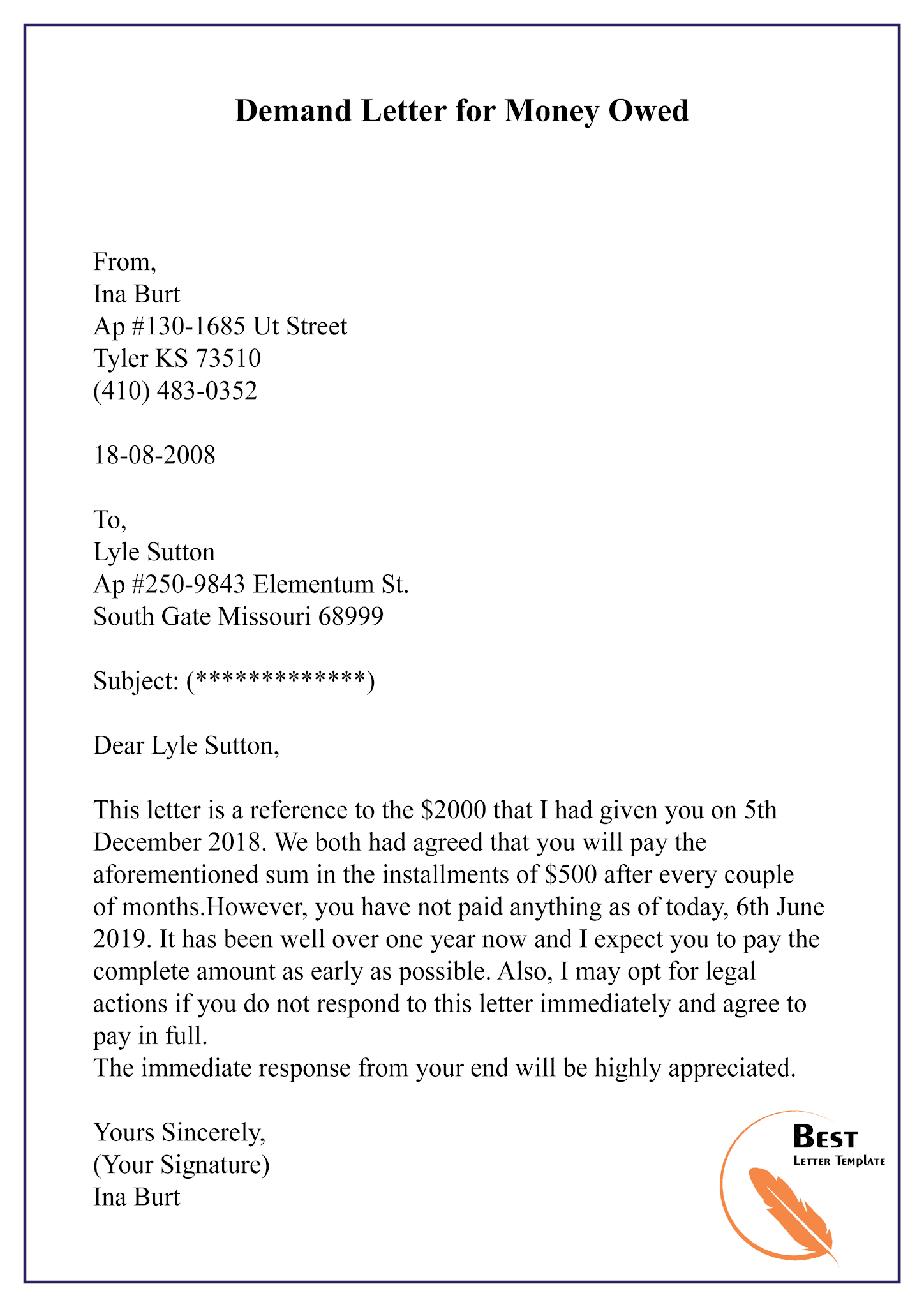

Money Owed To The Business Is Known As