In the realm of financial planning and fiscal responsibility, the master budget stands as the cornerstone, the very blueprint that charts the course for organizational success. Embarking on the creation of a master budget requires a methodical approach, with a well-defined starting point serving as the anchor upon which the entire edifice is constructed. In this comprehensive guide, we shall explore the customary inception of a master budget, delving into the origins and methodologies employed to lay the foundation for sound financial management.

Image: repeter.vercel.app

Laying the Foundation: The Role of Financial History

The genesis of a master budget is intricately linked to the organization’s financial history. The annals of the past, chronicling revenues, expenses, assets, and liabilities, provide an invaluable repository of wisdom that informs the budget’s future direction. By meticulously analyzing historical financial data, organizations can discern patterns, identify trends, and gain insights into the drivers of their financial performance. This historical context serves as the bedrock upon which the master budget is constructed, ensuring that the projections and targets are rooted in empirical evidence rather than mere speculation.

Embracing Forecasts: Charting a Course for the Future

While historical data provides a retrospective vantage point, the master budget’s true power lies in its ability to prognosticate and forecast future financial outcomes. Armed with sophisticated forecasting techniques and market intelligence, organizations can project revenues, expenses, and other key financial metrics. These forecasts, carefully calibrated against industry benchmarks and economic indicators, serve as the compass guiding the organization’s financial trajectory. By incorporating realistic and data-driven forecasts into the master budget, organizations can proactively anticipate market shifts, mitigate risks, and seize opportunities for growth and profitability.

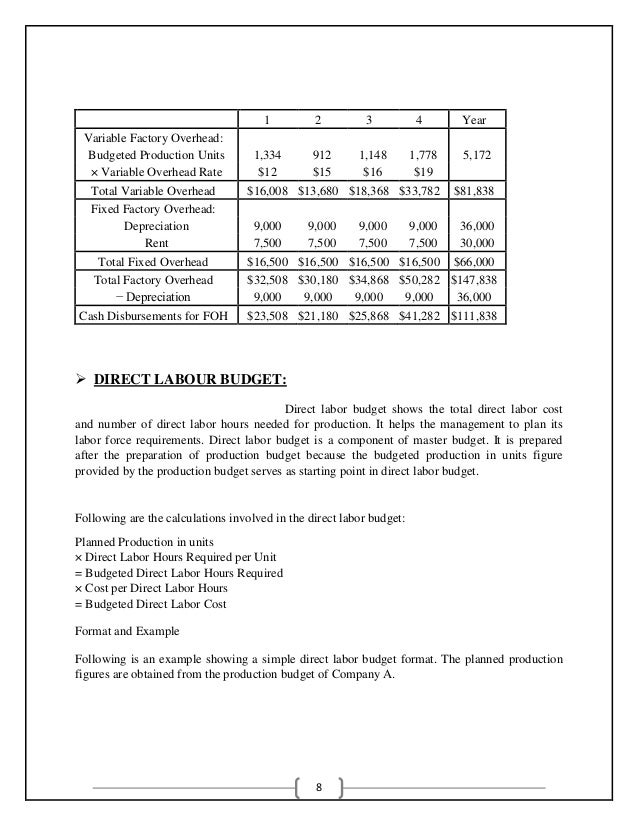

Operational Synergies: Interweaving Functional Budgets

The master budget is not an isolated entity but rather a harmonious convergence of functional budgets, each representing a distinct operational area within the organization. These functional budgets, meticulously crafted by department heads, articulate the projected revenues, expenses, and financial objectives for their respective spheres of influence. Whether it’s sales targets, production costs, or marketing expenditures, the master budget consolidates these functional budgets into a comprehensive and cohesive financial roadmap.

Image: www.chegg.com

Balancing Act: Striking the Equilibrium of Income and Expenses

At the heart of the master budget lies the delicate balancing act of aligning projected income with anticipated expenses. This intricate dance ensures that the organization’s financial resources are allocated judiciously, optimizing profitability and ensuring long-term sustainability. The master budget meticulously reconciles estimated revenues from operations, investments, and other sources with the projected expenses associated with the organization’s day-to-day functioning, capital expenditures, and debt servicing.

Managing Liquidity: A Lifeline for Financial Stability

A well-crafted master budget places paramount importance on managing liquidity, the lifeblood of any organization. By carefully forecasting cash flows, organizations can proactively identify potential cash shortages and devise strategies to maintain adequate levels of liquidity. This includes managing working capital, optimizing inventory levels, and exploring external financing options. The master budget provides a comprehensive overview of the organization’s cash position, empowering decision-makers to navigate financial fluctuations with confidence.

Expert Counsel: Navigating the Nuances of Budgeting

Venturing into the labyrinthine world of budgeting can be fraught with complexities and challenges. Seek the guidance of experienced professionals to steer your organization towards financial success. Certified Public Accountants (CPAs) and financial analysts possess the requisite knowledge and expertise to assist with master budget preparation, providing valuable insights and ensuring adherence to best practices. Their contributions can greatly enhance the efficacy and accuracy of the budgeting process, minimizing risks and optimizing outcomes.

FAQ: Unraveling Common Budgeting Conundrums

Q: What is the significance of variance analysis in the budgeting process?

A: Variance analysis is a critical tool for evaluating the accuracy of a master budget. It involves comparing actual financial results with budgeted projections, identifying discrepancies, and analyzing the underlying causes of these variances. This enables organizations to make informed adjustments to their budgeting process, enhancing its precision and effectiveness.

Q: How can organizations manage the risks associated with budgeting?

A: Risk management is an integral part of the budgeting process. Organizations can employ sensitivity analysis, scenario planning, and stress testing to assess the potential impact of various factors on their financial performance. By understanding the risks involved, organizations can develop contingency plans and mitigate the likelihood of adverse outcomes.

The Usual Starting Point For A Master Budget Is

Call to Action

Embracing a robust and well-structured master budget is not merely an accounting exercise but a strategic imperative for any organization aspiring towards financial excellence. By delving into the genesis of a master budget and comprehending the intricacies involved, you can harness its power to optimize resource allocation, enhance decision-making, and propel your organization towards enduring success. Are you ready to elevate your budgeting proficiency and unlock the full potential of your organization’s financial performance?